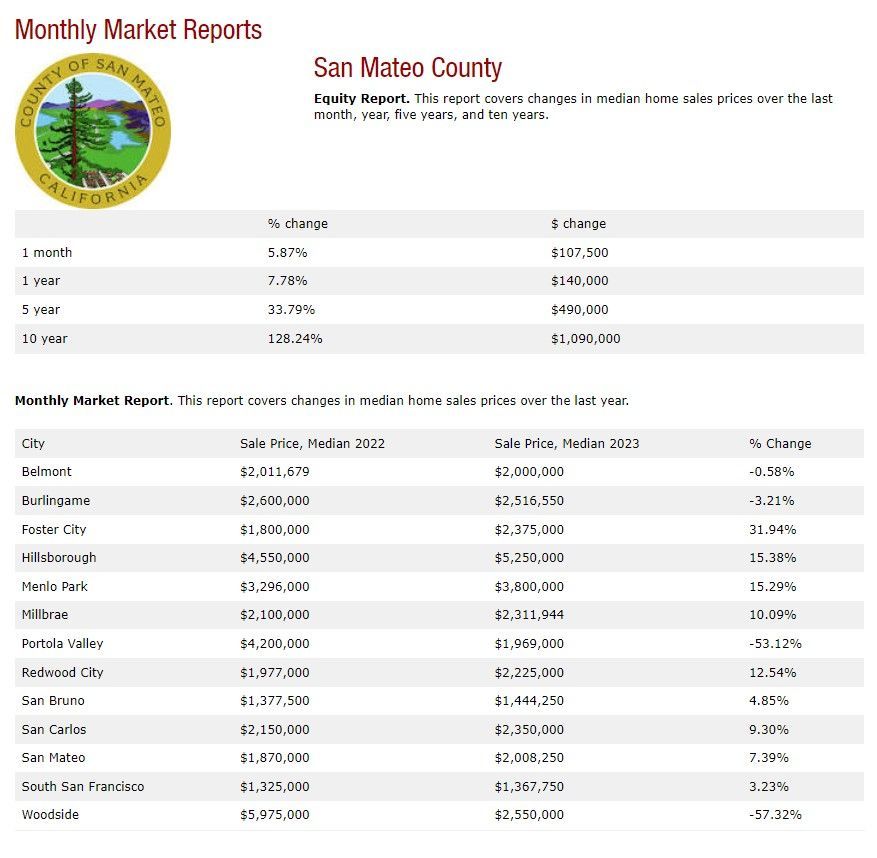

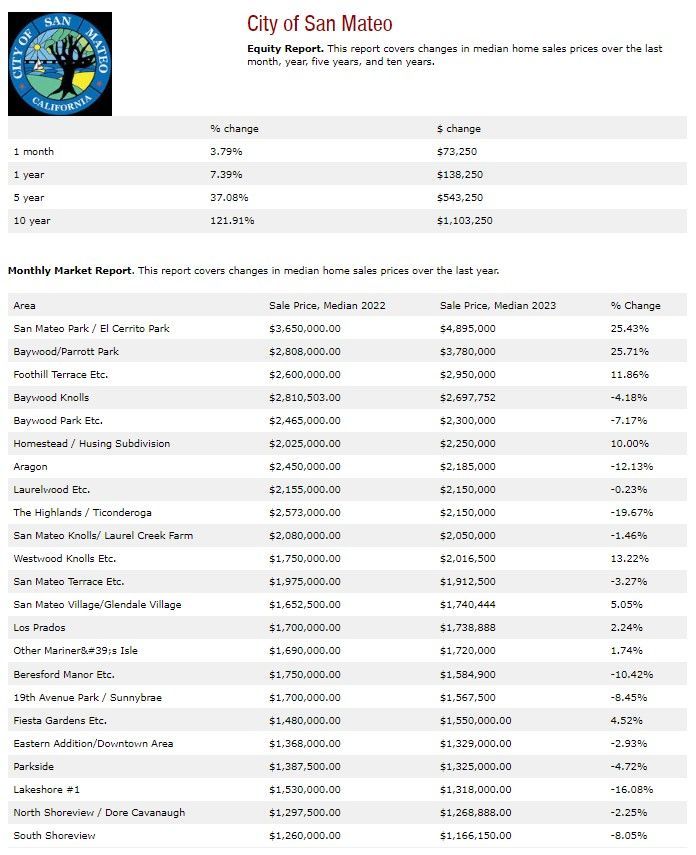

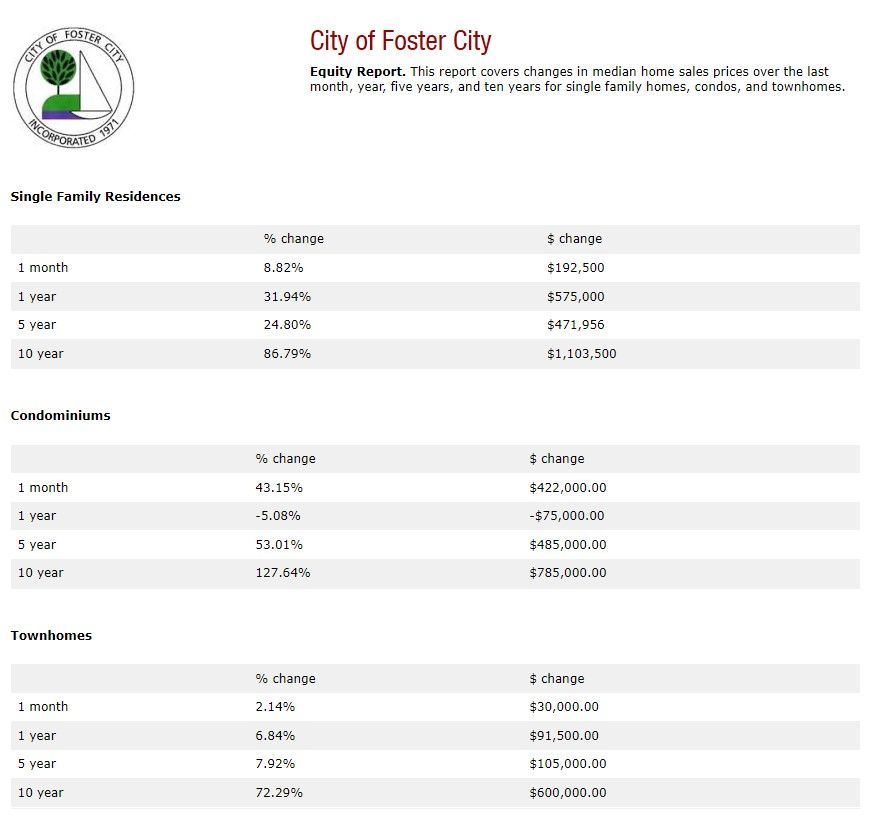

November 2023 San Mateo County Market Update

Is the Bay Area Real Estate Market really going to burst?

We all see national headlines like the one from Fortune above that plant the idea of an impending market collapse. The headline even quotes a reputable source, The National Association of REALTORS.

National news headlines are designed more for clicks and engagement than for delivering a full picture of information. In the full article, Fortune writer Sydney Lake compares the compounding effects of high mortgage rates, high prices, and low inventory seen in today’s market, and points to the pace of 2023 home sales nationally as being the lowest seen since the 2008 subprime mortgage crisis. The article discusses mortgage rates as a main culprit in creating a “lock-in effect” to explain the slowing of existing home sales. The largest portion of homes on the market are created when existing homeowners move or trade up, but more than 90% of existing homeowners are locked into mortgage rates below 6%. With these “velvet handcuffs” homeowners are reluctant to reenter the market as mortgage rates are climbing toward 8%. This creates the “lock-in effect”, slowing the cycle of home sales.

How does the national view compare with the California Real Estate Market?

The California Association of REALTORS in September 2023 released their 2024 California Housing Market Forecast which expects sales in 2024 to increase 22.9% over 2023’s projected pace and the median home price to climb 6.2% state-wide. This hinges on the prediction that cooling inflation will bring down mortgage rates in 2024 to “create a more favorable market environment to spur California home sales next year.”

“2024 will be a better year for the California housing market for both buyers and sellers as mortgage interest rates are expected to decline next year,” said C.A.R. President Jennifer Branchini, a Bay Area REALTOR®. “A more favorable market environment with lower borrowing costs, coupled with an increase in available homes for sale, will motivate buyers and sellers to reenter the market next year. First-time buyers who were squeezed out by the highly competitive market in the last couple of years will try to attain their American dream next year. Repeat buyers who have overcome the “lock-in effect” will also return to the market as mortgage rates begin to trend down.”

“With the economy expected to soften in 2024, the Federal Reserve Bank will begin loosening its monetary policy next year. Mortgage rates will trend down throughout 2024, and the average 30-year fixed rate mortgage could reach the mid-5% range by the end of next year,” said C.A.R. Senior Vice President and Chief Economist Jordan Levine. “Buyers will have more financial flexibility to purchase homes at higher prices, which could generate increased housing demand and result in more upward pressure on home prices.”

Do you have questions about our local San Mateo County Real Estate Market?